Wednesday, April 30, 2008

Non-Event Fed Day

IF I didn't know the fed was releasing a statement and might drop the rate today,,,, but the movment or lack there of was a flat day if you ask me. Good for my account as time ticked away. We actually moved down some and my overall delta is coming closer to a neutral position.

Sunday, April 27, 2008

Managing Delta

Looking at my account I can see if I'm too bullish/bearish and adjust accordingly just by looking at my delta number. I found this article below which helps explain Delta.

Going Beyond Simple Delta: Understanding Position Delta

by John Summa, CTA, PhD, Founder of OptionsNerd.com (Contact Author Biography)

Email ArticlePrintComments

The article Getting to Know the Greeks discusses risk measures such as delta, gamma, theta and vega, which are summarized in figure 1 below. This article takes a closer look at delta as it relates to actual and combined positions - known as position delta - a very important concept for option sellers. Below I begin with a quick review of the risk measure delta, and then proceed to explaining position delta, including an example of what it means to be position-delta neutral.

Simple Delta

Let's review some basic concepts before jumping right into position delta. Delta is one of four major risk measures used by option traders, all of which are outlined in figure 1 below. Delta measures the degree to which an option is exposed to shifts in the price of the underlying asset (i.e. stock) or commodity (i.e. futures contract). Values range from +1.0 to –1.0 (or +100 to –100, depending on the convention employed). For example, if you buy a call or a put option that is just out of the money (i.e. the strike price of the option is above the price of the underlying if the option is a call and below the price of the underlying if the option is a put), then the option will always have a delta value that is somewhere between 1.0 and –1.0. Generally speaking an at-the-money option usually has a delta at approximately 0.5 or -0.5.

Vega Theta Delta Gamma

Measures the impact of a change in volatility. Measures the impact of a change in time remaining. Measures impact of a change in the price of underlying. Measures the rate of change of delta.

Figure 1 - Delta and the other "Greeks".

Figure 2 contains some hypothetical values for S&P 500 call options that are at, out and in the money (in all these cases I am using long options). Call delta values range from 0 to 1.0, while put delta values range from 0 to –1.0. As you can see, the at-the-money call option (strike price at 900) in figure 2 has a 0.5 delta, while the out-of-the-money (strike price at 950) call option has a 0.25 delta and the in-the-money (strike at 850) has a delta value of 0.75.

Keep in mind that these call delta values are all positive because we are dealing with long call options, a point to which we will return later. If these were puts, the same values would have a negative sign attached to them. This reflects the fact that put options increase in value when the underlying asset price falls. (An inverse relationship is indicated by the negative delta sign.) You will see below, when we look at short option positions and the concept of position delta, that the story gets a bit more complicated.

Strikes Delta

950 0.25

900 0.5

850 0.75

Note: We are assuming that the underlying S&P 500 is trading at 900

Figure 2 - Hypothetical S&P 500 long call options.

At this point you might be wondering what these delta values are telling you. Let me offer an example to help illustrate the concept of simple delta and the meaning of these values. If an S&P 500 call option has a delta of 0.5 (for a near or at-the-money option), a one-point move (which is worth $250) of the underlying futures contract would produce a 0.5 (or 50%) change (worth $125) in the price of the call option. A delta value of 0.5, therefore, tells you that for every $250 change in value of the underlying futures, the option changes in value by about $125. If you were long this call option and the S&P 500 futures move up by one point, your call option would gain approximately $125 in value, assuming no other variables change in the short run. We say "approximately" because as the underlying moves, delta will change as well. (To understand this relationship, Getting to know the Greeks.)

Be aware that as the option gets further in the money, delta approaches 1.00 on a call and –1.00 on a put. At these extremes there is a near or actual one-for-one relationship between changes in the price of the underlying and subsequent changes in the option price. In effect, at delta values of –1.00 and 1.00, the option mirrors the underlying in terms of price changes.

Also bear in mind that this simple example assumes no change in other variables like the following: (1) delta tends to increase as you get closer to expiration for near or at-the-money options; (2) delta is not a constant, a concept related to gamma, another risk measurement, which is a measure of the rate of change of delta given a move by the underlying; (3) delta is subject to change given changes in implied volatility.

Long vs. Short Options and Delta

As a segue into looking at position delta, let me say a few words about how short and long positions change the picture somewhat. First, the negative and positive signs for values of delta mentioned above do not tell the full story. As indicated in figure 3 below, if you are long a call or a put (that is, you purchased them to open these positions), then the put will be delta negative and the call delta positive; however, our actual position will determine the delta of the option as it appears in our portfolio. Note how the signs are reversed for short put and short call.

Long Call Short Call Long Put Short Put

Delta Positive Delta Negative Delta Negative Delta Positive

Figure 3 - Delta signs for long and short options.

The delta sign in your portfolio for this position will be positive, not negative. This is because the value of the position will increase if the underlying increases. Likewise, if you are short a call position, you will see that the sign is reversed. The short call now acquires a negative delta, which means that if the underlying rises, the short call position will lose value. This is getting us closer to an actual discussion of position delta.

Position Delta

Position delta can be understood by reference to the idea of a hedge ratio. Delta is in effect a hedge ratio because it tells us how many options contracts are needed to hedge a long or short position in the underlying. It is a very easy concept to grasp.

Advertisement

Get a FREE Options Trading Manual from the Chicago Board of Trade

Get a free 21-page book on learning to trade options from the Chicago Board of Trade. If you are new to the option market, this booklet is designed for you! No cost or obligation. Click Here to get this book Today!

For example, if an at-the-money call option has a delta value of approximately 0.5 - which means that there is a 50% chance the option will end in the money and a 50% chance it will end out of the money - then this delta tells us that it would take two at-the-money call options to hedge one short contract of the underlying. In other words, you need two long call options to hedge one short futures contract. (Two long call options x delta of 0.5 = position delta of 1.0, which equals one short futures position). This means that a one-point rise in the S&P 500 futures (a loss of $250), which you are short, will be offset by a one-point (2 x $125 = +$250) gain in the value of the two long call options. In this example we would say that we are position-delta neutral.

By changing the ratio of calls to number of positions in the underlying, we can turn this position delta either positive or negative. For example, if are bullish we might add another long call, so we are now delta positive because our overall strategy is set to gain if the futures rise. We would have three long calls with delta of 0.5 each, which means we have a net long position delta by +0.5. On the other hand, if we are bearish, we could reduce our long calls to just one, which we would now make us net short position delta. This means that we are net short the futures by -0.5.

Conclusion

This article explains the concept of simple delta and then proceeds to explain how position delta is a measure of how net long or net short the underlying you are when taking into account your entire portfolio of options (and futures).

Original Article Link:

http://www.investopedia.com/articles/optioninvestor/03/021403.asp

Going Beyond Simple Delta: Understanding Position Delta

by John Summa, CTA, PhD, Founder of OptionsNerd.com (Contact Author Biography)

Email ArticlePrintComments

The article Getting to Know the Greeks discusses risk measures such as delta, gamma, theta and vega, which are summarized in figure 1 below. This article takes a closer look at delta as it relates to actual and combined positions - known as position delta - a very important concept for option sellers. Below I begin with a quick review of the risk measure delta, and then proceed to explaining position delta, including an example of what it means to be position-delta neutral.

Simple Delta

Let's review some basic concepts before jumping right into position delta. Delta is one of four major risk measures used by option traders, all of which are outlined in figure 1 below. Delta measures the degree to which an option is exposed to shifts in the price of the underlying asset (i.e. stock) or commodity (i.e. futures contract). Values range from +1.0 to –1.0 (or +100 to –100, depending on the convention employed). For example, if you buy a call or a put option that is just out of the money (i.e. the strike price of the option is above the price of the underlying if the option is a call and below the price of the underlying if the option is a put), then the option will always have a delta value that is somewhere between 1.0 and –1.0. Generally speaking an at-the-money option usually has a delta at approximately 0.5 or -0.5.

Vega Theta Delta Gamma

Measures the impact of a change in volatility. Measures the impact of a change in time remaining. Measures impact of a change in the price of underlying. Measures the rate of change of delta.

Figure 1 - Delta and the other "Greeks".

Figure 2 contains some hypothetical values for S&P 500 call options that are at, out and in the money (in all these cases I am using long options). Call delta values range from 0 to 1.0, while put delta values range from 0 to –1.0. As you can see, the at-the-money call option (strike price at 900) in figure 2 has a 0.5 delta, while the out-of-the-money (strike price at 950) call option has a 0.25 delta and the in-the-money (strike at 850) has a delta value of 0.75.

Keep in mind that these call delta values are all positive because we are dealing with long call options, a point to which we will return later. If these were puts, the same values would have a negative sign attached to them. This reflects the fact that put options increase in value when the underlying asset price falls. (An inverse relationship is indicated by the negative delta sign.) You will see below, when we look at short option positions and the concept of position delta, that the story gets a bit more complicated.

Strikes Delta

950 0.25

900 0.5

850 0.75

Note: We are assuming that the underlying S&P 500 is trading at 900

Figure 2 - Hypothetical S&P 500 long call options.

At this point you might be wondering what these delta values are telling you. Let me offer an example to help illustrate the concept of simple delta and the meaning of these values. If an S&P 500 call option has a delta of 0.5 (for a near or at-the-money option), a one-point move (which is worth $250) of the underlying futures contract would produce a 0.5 (or 50%) change (worth $125) in the price of the call option. A delta value of 0.5, therefore, tells you that for every $250 change in value of the underlying futures, the option changes in value by about $125. If you were long this call option and the S&P 500 futures move up by one point, your call option would gain approximately $125 in value, assuming no other variables change in the short run. We say "approximately" because as the underlying moves, delta will change as well. (To understand this relationship, Getting to know the Greeks.)

Be aware that as the option gets further in the money, delta approaches 1.00 on a call and –1.00 on a put. At these extremes there is a near or actual one-for-one relationship between changes in the price of the underlying and subsequent changes in the option price. In effect, at delta values of –1.00 and 1.00, the option mirrors the underlying in terms of price changes.

Also bear in mind that this simple example assumes no change in other variables like the following: (1) delta tends to increase as you get closer to expiration for near or at-the-money options; (2) delta is not a constant, a concept related to gamma, another risk measurement, which is a measure of the rate of change of delta given a move by the underlying; (3) delta is subject to change given changes in implied volatility.

Long vs. Short Options and Delta

As a segue into looking at position delta, let me say a few words about how short and long positions change the picture somewhat. First, the negative and positive signs for values of delta mentioned above do not tell the full story. As indicated in figure 3 below, if you are long a call or a put (that is, you purchased them to open these positions), then the put will be delta negative and the call delta positive; however, our actual position will determine the delta of the option as it appears in our portfolio. Note how the signs are reversed for short put and short call.

Long Call Short Call Long Put Short Put

Delta Positive Delta Negative Delta Negative Delta Positive

Figure 3 - Delta signs for long and short options.

The delta sign in your portfolio for this position will be positive, not negative. This is because the value of the position will increase if the underlying increases. Likewise, if you are short a call position, you will see that the sign is reversed. The short call now acquires a negative delta, which means that if the underlying rises, the short call position will lose value. This is getting us closer to an actual discussion of position delta.

Position Delta

Position delta can be understood by reference to the idea of a hedge ratio. Delta is in effect a hedge ratio because it tells us how many options contracts are needed to hedge a long or short position in the underlying. It is a very easy concept to grasp.

Advertisement

Get a FREE Options Trading Manual from the Chicago Board of Trade

Get a free 21-page book on learning to trade options from the Chicago Board of Trade. If you are new to the option market, this booklet is designed for you! No cost or obligation. Click Here to get this book Today!

For example, if an at-the-money call option has a delta value of approximately 0.5 - which means that there is a 50% chance the option will end in the money and a 50% chance it will end out of the money - then this delta tells us that it would take two at-the-money call options to hedge one short contract of the underlying. In other words, you need two long call options to hedge one short futures contract. (Two long call options x delta of 0.5 = position delta of 1.0, which equals one short futures position). This means that a one-point rise in the S&P 500 futures (a loss of $250), which you are short, will be offset by a one-point (2 x $125 = +$250) gain in the value of the two long call options. In this example we would say that we are position-delta neutral.

By changing the ratio of calls to number of positions in the underlying, we can turn this position delta either positive or negative. For example, if are bullish we might add another long call, so we are now delta positive because our overall strategy is set to gain if the futures rise. We would have three long calls with delta of 0.5 each, which means we have a net long position delta by +0.5. On the other hand, if we are bearish, we could reduce our long calls to just one, which we would now make us net short position delta. This means that we are net short the futures by -0.5.

Conclusion

This article explains the concept of simple delta and then proceeds to explain how position delta is a measure of how net long or net short the underlying you are when taking into account your entire portfolio of options (and futures).

Original Article Link:

http://www.investopedia.com/articles/optioninvestor/03/021403.asp

Saturday, April 26, 2008

Friday, April 25, 2008

Current Layout

Tuesday, April 22, 2008

What the heck?? Iron Condor

Craig does a such great job going over his Condors let see if this helps explain it..

Current Iron Condors

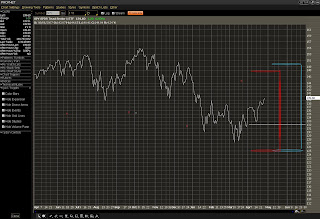

I rolled my lower May leg up and started entering in June. My Credit for June was $2.10 with shorts at 800 and 640. Since the trades are longer in length and are selling time I’m using weekly closing prices before making any adjustments.

The chart above shows my trades. The Green brackets are a 23% Return in 57 days.

Sunday, April 20, 2008

Are The Bulls Back For Real?

Thursday, April 17, 2008

Theta

Option Theta

Theta shows how much value the option price will lose for every day that passes.

An option contract has a finite life, defined by the expiration date. As the option approaches its maturity date, an option contract's expected value becomes more certain with each day.

This Time Value, also called Extrinsic Value, represents the uncertainty of an option.

Theta is the calcuation that shows how much of this time value is eroding as each trading day passes - assuming all other inputs remain unchanged. Because of this negative impact on an option price, the Theta will always be a negative number.

For example, say an option has a theoretical price of 3.50 and is showing a Theta value of -0.20. Tomorrow, if the underlying market opens unchanged (opens at the same price as the previous days close) then the theoretical value of the option will now be worth 3.30 (3.50 - 0.20).

The above graph illustrates the effect on a OTM call option as it approaches maturity date. The increment as each day passes is what the Theta calculates.

You will notice that in the last remaining days of an option's life, it looses it's value quite rapidly.

This is one of the concepts traders use as a reason to short option contracts - to take advantage of this rapid rate of decay in an option's value as each trading day passes.

Theta shows how much value the option price will lose for every day that passes.

An option contract has a finite life, defined by the expiration date. As the option approaches its maturity date, an option contract's expected value becomes more certain with each day.

This Time Value, also called Extrinsic Value, represents the uncertainty of an option.

Theta is the calcuation that shows how much of this time value is eroding as each trading day passes - assuming all other inputs remain unchanged. Because of this negative impact on an option price, the Theta will always be a negative number.

For example, say an option has a theoretical price of 3.50 and is showing a Theta value of -0.20. Tomorrow, if the underlying market opens unchanged (opens at the same price as the previous days close) then the theoretical value of the option will now be worth 3.30 (3.50 - 0.20).

The above graph illustrates the effect on a OTM call option as it approaches maturity date. The increment as each day passes is what the Theta calculates.

You will notice that in the last remaining days of an option's life, it looses it's value quite rapidly.

This is one of the concepts traders use as a reason to short option contracts - to take advantage of this rapid rate of decay in an option's value as each trading day passes.

Credit:

Long EUR, Short USD

I'm Long the EUR and Short the USD. This is a new high plus a hedge against my other trades. With all the bullish in the market my portfolio delta is just slightly negative. Meaning my neutral trades while very much right where they need to be would be perfectly happy if we dropped some. Seeing how GOOGLE blew away earnings I see the market heading up Friday which will devalue the US dollar.

Weekends

Heading into the weekend = Options Time decay. My RUT and SPY trades are looking good. Not much happening this week. I did have an XLE iron condor that was run over on a 52 week high breakout. I rolled the bottom up and added twice as many lower spreads along the way. This certainly helped out in taking a much smaller loss.

Tonight Matt held an online meeting as Nicholas's baseball team had a team to beat as Ernie or I couldn't make it tonight! Sounds like I missed a great meeting.. Below are notes Matt posted to our Yahoo group. Thanks Matt!

"Below is a list of topics that we discussed during the online group meeting tonight. Please feel free to ask any questions that you may have.

Tickers:

MOO - Agricultural ETF (Tracks stocks like POT, MOS, etc.)

XME - Metals and Mining ETF

POT - Not a whole lot to say about this one other than it's bullish and earnings are coming up. The 190/185 Bull/Put Vertical has a nice credit if it can stay above these levels (I'm personally expecting a pullback before earnings).

CAM - Looking for a pull back; bumping up against resistance at 50; earnings coming up.

FWLT - Shorting opportunity; 64 appears to be good resistence

FLR - Shorting opportunity? A pullback could be in order and there are visible signs of divergence with the MACD (higher high's on less momentum; 160 is resistence

TSN - Broken above 200 MA on good volume. Today's action was extremely bullish with BIG volume and BIG white candle. Also, thanks to Terry, he pointed out that it's resting SMACK-DAB on 50% Fib line from the swing high of June 07 to the swing low of Jan. 08...Will it keep going?

$VIX - Last but not least....what's this thing going to do? I personally have it breaking below the uptrending support line and resting on a horizontal support line at ~20.35 (today's low). You can argue that MACD is getting weaker and this thing is going lower (divergence).

So where we go from here who knows, just manage your risk; Plan your trades and trade your plans..."

Tonight Matt held an online meeting as Nicholas's baseball team had a team to beat as Ernie or I couldn't make it tonight! Sounds like I missed a great meeting.. Below are notes Matt posted to our Yahoo group. Thanks Matt!

"Below is a list of topics that we discussed during the online group meeting tonight. Please feel free to ask any questions that you may have.

Tickers:

MOO - Agricultural ETF (Tracks stocks like POT, MOS, etc.)

XME - Metals and Mining ETF

POT - Not a whole lot to say about this one other than it's bullish and earnings are coming up. The 190/185 Bull/Put Vertical has a nice credit if it can stay above these levels (I'm personally expecting a pullback before earnings).

CAM - Looking for a pull back; bumping up against resistance at 50; earnings coming up.

FWLT - Shorting opportunity; 64 appears to be good resistence

FLR - Shorting opportunity? A pullback could be in order and there are visible signs of divergence with the MACD (higher high's on less momentum; 160 is resistence

TSN - Broken above 200 MA on good volume. Today's action was extremely bullish with BIG volume and BIG white candle. Also, thanks to Terry, he pointed out that it's resting SMACK-DAB on 50% Fib line from the swing high of June 07 to the swing low of Jan. 08...Will it keep going?

$VIX - Last but not least....what's this thing going to do? I personally have it breaking below the uptrending support line and resting on a horizontal support line at ~20.35 (today's low). You can argue that MACD is getting weaker and this thing is going lower (divergence).

So where we go from here who knows, just manage your risk; Plan your trades and trade your plans..."

Saturday, April 12, 2008

Forex and Spring Boards

For the last 4 months or so the Forex market has been making strong moves and becoming oversold or overbought real quick just like the US market. A one week move might just take a day or hours. Being on the right side of the trade this first time makes it that much more critical as a move against me is not unheard of and is usual but hitting my stop and then going in the original direction just draws down the account. So as of late I'm taking profits after a quick oversold/over bought move then going back in once the spring board is back to it's normal self with defined risk until the market finds some stability when a trend is more stable.

S.O.H.

Sit On Hands! Well the trades in my account are working just fine. All that needs to happen is time to tick away for about 4 weeks for the full credit but instead I'll roll out into June in about 3 weeks depending on where my positions are and opportunities at that point.

Thursday, April 10, 2008

Closed GBP/JPY and EUR/JPY

Closed 6:50am this morning with a 120% ROI. 150% on risk. These are bear market trades and the market is pretty bullish as of late.

Wednesday, April 9, 2008

Silver Update

After looking at silver last night I belive it has been oversold and will rise BUT I have too much overall direction risk currently so I shut it down.

Sunday, April 6, 2008

Saturday, April 5, 2008

The Best is always different. Email from Thinkorswim (Trading Broker)

Hello swimmers-

Our programmers are smart. Very smart. As babies, they reverse engineered the jack-in-the-box and turned their cribs into lowriders. As children, they arbed the lottery to earn enough money to buy new parents. As teens, they commandeered satellites with their laptops to share their secret anti-acne formulas with their super-genius/hormonally-challenged brethren. And in college, well, let's just say it wasn't your IT guy who averted a Y2K meltdown. Now as adults, they build thinkorswim. But don't be nervous. They're on your side.

We will be releasing version 1084 on Saturday, March 29, at 5:00 am CDT. New features include:

New Futures Format including quotes for Options on Futures

We now offer a new futures layout that displays all the tradable months and the corresponding option series. Please note that trading options on futures will not begin for approximately another two weeks. The new futures user interface will use the root symbol for each product such as S&P 500 (/ES), Russell 2000 (/ER2), MidCap 400 (/EMD), Eurodollar (/GE), Nasdaq 100 (/NQ), Corn (/ZC), Gold (/ZG), Silver (/ZI), Soybean (/ZS), Soy Meal (/ZM), Soy Oil (/ZL), Oats (/ZO), Wheat (/ZW) and Fed Funds (/ZQ), and will expand from there. ...................................................................................

Our programmers are smart. Very smart. As babies, they reverse engineered the jack-in-the-box and turned their cribs into lowriders. As children, they arbed the lottery to earn enough money to buy new parents. As teens, they commandeered satellites with their laptops to share their secret anti-acne formulas with their super-genius/hormonally-challenged brethren. And in college, well, let's just say it wasn't your IT guy who averted a Y2K meltdown. Now as adults, they build thinkorswim. But don't be nervous. They're on your side.

We will be releasing version 1084 on Saturday, March 29, at 5:00 am CDT. New features include:

New Futures Format including quotes for Options on Futures

We now offer a new futures layout that displays all the tradable months and the corresponding option series. Please note that trading options on futures will not begin for approximately another two weeks. The new futures user interface will use the root symbol for each product such as S&P 500 (/ES), Russell 2000 (/ER2), MidCap 400 (/EMD), Eurodollar (/GE), Nasdaq 100 (/NQ), Corn (/ZC), Gold (/ZG), Silver (/ZI), Soybean (/ZS), Soy Meal (/ZM), Soy Oil (/ZL), Oats (/ZO), Wheat (/ZW) and Fed Funds (/ZQ), and will expand from there. ...................................................................................

Does 41% Return in 39 days with a high probability sound good?

Friday, April 4, 2008

Subscribe to:

Comments (Atom)